Have you ever wanted to test a trading idea — without risking a single dollar? That’s exactly why a demo exists. The fp markets demo gives you a risk-free way to learn platforms, try strategies, and build confidence before you go live.

What is the FP Markets Demo (Quick Answer)

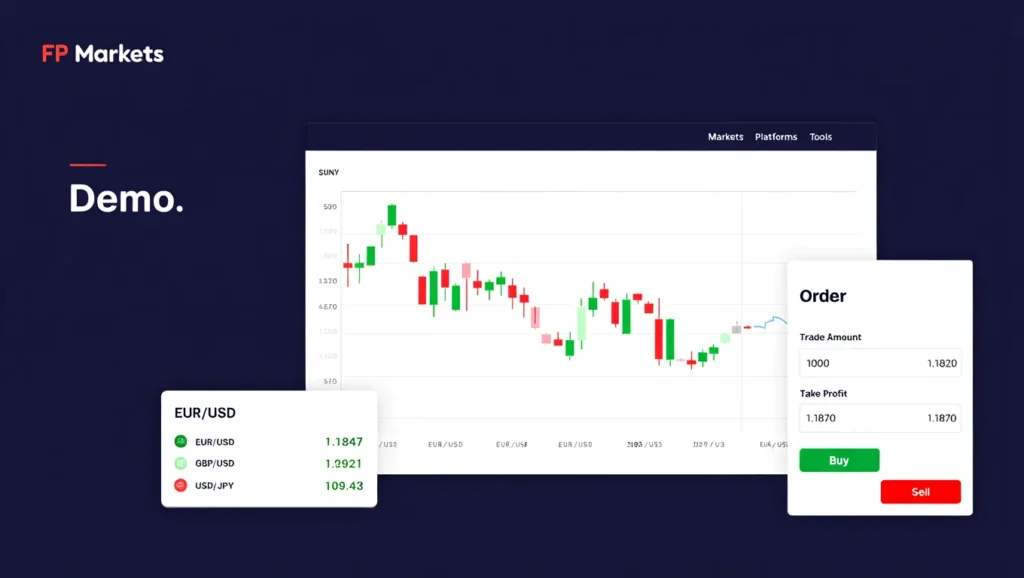

An fp markets demo is a simulated trading account that mirrors live market prices and platform tools but uses virtual money. It’s available across FP Markets’ main platforms so you can test MT4, MT5, IRESS and the web/mobile interfaces under real conditions — without risking any capital.

Why Use an FP Markets Demo? (Short, Human Reasons)

- Learn the platform: get comfortable with charts, orders, and indicators.

- Test strategies: try a new system or tweak an EA before using real money.

- Understand execution & fees: you’ll see spreads and slippage that reflect live conditions.

- Reduce stress: trading live feels different. Demo first, then move slowly. (Tiny habit that saves money.)

Platforms Supported By the FP Markets Demo

FP Markets offers demo accounts across its major platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), IRESS, WebTrader and mobile apps. That means whether you’re into expert advisors on MT4/MT5 or want IRESS’s advanced desktop tools, you can test it first with an fp markets demo.

Demo Features — What to Expect

- Virtual funds: demo accounts commonly start with a simulated balance (often around US$100,000) that you can use to place trades. Some sources say you can request higher demo balances from support.

- Real-time pricing: demo prices match live market feeds so your testing shows realistic results.

- Access to tools: indicators, charting, EAs, and order types are available same as live accounts.

- Inactivity rules: some reports say demo accounts expire after 30 days of inactivity; other reviews describe unlimited demo access. Because policies can change, check the FP Markets demo terms or ask support for the current rule.

Is FP Markets Regulated and Safe to Practice With?

FP Markets is an established broker founded in 2005 and operates under reputable regulators — including the Australian Securities and Investments Commission (ASIC) for Australian accounts and CySEC for European accounts. That regulatory oversight applies to the broker overall; demo accounts are for practice but the broker’s live services are regulated.

Who Should Use an FP Markets Demo?

- Absolute beginners who need hands-on practice.

- Day traders and scalpers who want to test speed and spreads.

- Algorithmic traders who need to debug EAs on MT4/MT5.

- Anyone switching brokers who wants to feel the platform before funding.

Step-by-Step: How to Open an FP Markets Demo (Fast)

- Go to FP Markets and find the “Try a Demo” or Quick Start area.

- Provide your name, email and country.

- Choose the platform (MT4, MT5, IRESS, WebTrader).

- Pick account type (Standard/Raw) and demo balance if offered.

- Download the platform or use WebTrader, then log in with the demo credentials.

If you get stuck, FP Markets has platform guides and tutorial pages for MT4 and MT5 that walk you through downloads and setup.

How to Make the Most of Your FP Markets Demo (Real Tips)

- Treat it like real money. Keep records and a trading journal.

- Use limited capital sizing in demo to mirror what you’ll risk live. Don’t trade like you have infinite funds.

- Backtest a strategy, then forward-test on demo for weeks. Check drawdowns and win rates.

- Test EAs under market conditions (news hours, low liquidity) to see real behaviour.

- Try multiple platforms. If you plan to use IRESS for shares and MT5 for forex, test both with the fp markets demo.

Common Demo Pitfalls (And How to Avoid Them)

- Overconfidence: Demo has no emotional pressure. Use smaller position sizes in demo to simulate stress.

- Ignoring slippage & fees: Some demo accounts underplay slippage; always compare demo spreads to live spreads during high-volatility windows.

- Not testing order types: Market vs. limit vs. stop behavior matters under real conditions—test them all.

- Letting demo run idle: If your demo expires after inactivity (check the policy), you might lose your setup — save templates and export settings.

How FP Markets Demo Stacks Up Vs Other Brokers

FP Markets leans toward traders who want institutional-grade execution, low spreads (on Raw accounts), and multiple platform choices. Its demo mirrors these strengths, making it a solid practice ground for both manual and algorithmic traders. Independent reviews praise its platform range and execution, though policies like demo expiry can vary by source — always confirm with FP Markets directly.

Quick Checklist Before Switching From Demo to Live

- Your demo performance is consistently profitable (after adjusting for realistic risk).

- You’ve tested during major news events and low-liquidity times.

- You’ve confirmed live spreads, commission, and deposit options.

FAQ’s (Short & Useful)

How Long Does an FP Markets Demo Last?

Sources differ: some say demo accounts require activity at least once every 30 days to remain active; others report unlimited demos. Policies change, so check FP Markets’ demo terms or contact support to confirm current rules.

Can I Use EA’s On the FP Markets Demo?

Yes. EAs and automated strategies are supported on MT4 and MT5 demo accounts.

Is the FP Markets Demo Free?

Yes — the demo is free and meant for practice and learning.

Final Thoughts — is The FP Markets Demo Worth Your Time?

If you want to learn platforms, test EAs, or practice order execution without risk, the fp markets demo is a practical and professional environment to do it. It supports major trading platforms, mirrors live prices, and gives you a safe place to fail and learn before you risk capital. Just remember: treat demo trading like real trading if you want the lessons to stick.